Getting a decent rental property in a nice location within budget for an average Nigerian is hard, it is usually above the pocket of many, especially in major capital cities like Lagos, Ibadan, Abuja and Port-Harcourt. This is because many Nigerians earn fixed salaries which don’t grow as fast as the annual inflation rates, the increasing population, and the growing expenses and bills contribute to these rental payment difficulties.

Because of the lingering rent financing constraints being faced by many Nigerians as explained earlier, a Rental Financing Startup called Kwaba is helping interested Nigerians pay their rent directly to the landlord in bulk while the person repays the loan amount monthly as selected by the individual at the point of signing up.

In this article, I will be introducing you to Kwaba Rental Financing and I will be explaining;

- How Kwaba Works

- Rental Savings on Kwaba Platform

- Loan Processing on Kwaba

- Kwaba Eligibility Criteria

- How Secured is Fund Saved to Kwaba

How Kwaba Rental Property Finance Works

Table of Contents

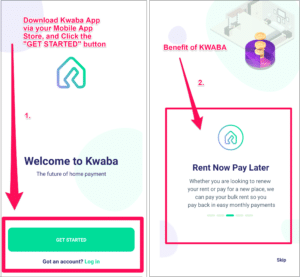

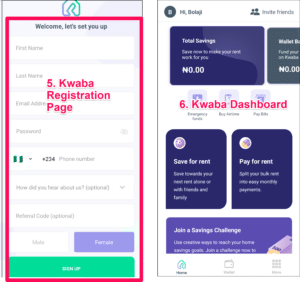

To access Kwaba Rent Financing Service, you will need to download Kwaba App and then Sign up. After signing up, you will have to provide your;

- Full name

- Phone Number

- Password

After your sign up, you will proceed to tell the company details about your accommodation status and the options here include;

- Looking to renew my rent

- Want to pay for a new place

- I’m still searching

After selecting any of the above options, you will state the price of your rent followed by how much you have at hand then the amount you wish to get from Kwaba, the amount you earn monthly, and finally your repayment plan.

After successful application submission, Kwaba will run some background checks to make sure you are creditworthy and also to verify the information you provided.

If cleared, Kwaba will make the payment of the sum you requested to the landlord while you pay back the stipulated amount shown in the repayment calculation.

Kwaba beyond Rental Savings

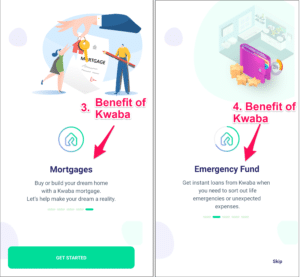

In addition to getting loans on Kwaba, you can also use Kwaba to save money and get instant loans and pay for your home in convenient instalments.

With Kwaba, you can get these things done effortlessly;

- Rent savings: Save towards your rent alone or with friends and family.

- Instant loans Access instant loans 24/7 and get paid directly into your bank account

- Rent now, pay later: Split your bulk rent or rent deposit into convenient payments

- Mortgages: Buy your dream home sooner rather than later with a Kwaba mortgage

Loan Processing on Kwaba

From the day you applied, it can take between a few days to a month to get your loan depending on the amount and how soon the company can verify the information you submitted.

If your loan application is getting delayed, Kwaba customer care lines are open from Monday to Friday, click here for more

Kwaba Eligibility Criteria

As long as you work, have a clean credit history and are above 21 years of age, you are eligible. At the time of this writing. Kwaba Rental Financing option is only available to the residents of Lagos, Abuja and Portharcourt.

How Secured is Fund Saved to Kwaba

your savings are safe as they are insured by NDIC and secured with bank-grade security features. According to Kwaba, the platform/company work with the Payment Card Industry Data Security Standard – PCI DSS, which ensures your money and data are safe and fraud-proof.

Learning Review

Use Kwaba to save, get instant loans and pay for your home in convenient instalments. As a renter or an aspiring homeowner, Kwaba helps you make flexible payments for any property.

As a learning recap, never forget to understand;

- How Kwaba Rental Property Finance Works

- Rental Savings on Kwaba Platform

- Loan Processing on Kwaba

- Kwaba Eligibility Criteria

- How Secured is Fund Saved to Kwaba

Final Remarks

Kwaba is a nice concept that can quickly dominate Nigeria with its service as the country is going through hard times right now and most people can hardly afford the increasing cost of rent renewals.

Disclaimer;

The contents of this article are for informational purposes only. Always do your research before you take any business advice.

Note: this is not a promotional article, rather did the company pay me to write about them. However, I may earn some commission if you use my referral link to sign up on their platform.

Have you tried using Kwaba? please share your experience with others via the comment box.

You may be interested in learning about;

The What, How and Why of Real Estate Trading

Are you working in the real estate industry? if yes, please try to read this post;

20 Ultimate Ways to Promote your Real Estate Business on the Internet

Author Profile

- I am Bolaji Afolabi, a Partner at Globalclique, and a CIO @ Ibugbe and Partners - Pan African Real Estate + Technology + HR Consulting Group. Bolaji is celebrated for his expertise in seamlessly blending human capital with cutting-edge technologies, and also providing professional advisory services.

Latest entries

REAL ESTATEApril 4, 2024Understanding Real Estate Joint Ventures: A Comprehensive Guide

REAL ESTATEApril 4, 2024Understanding Real Estate Joint Ventures: A Comprehensive Guide GROWTH HACKINGSeptember 5, 20228 Powerful Ways to Look Good and Feel Great

GROWTH HACKINGSeptember 5, 20228 Powerful Ways to Look Good and Feel Great GROWTH HACKINGSeptember 5, 2022The 3 Core Types of Income

GROWTH HACKINGSeptember 5, 2022The 3 Core Types of Income GROWTH HACKINGSeptember 5, 2022Smart P.O.M Model for Business Success

GROWTH HACKINGSeptember 5, 2022Smart P.O.M Model for Business Success

One thought on “How to Finance a Rental Property in Nigeria”